Brand Guide & Media Kit

Welcome to TrueHaven Claims Consulting

The Experts on Your Side in Insurance Recovery.

Mision, Vision & Core Values

MISSION

To advocate for policyholders with integrity, professionalism, and empathy—ensuring fair, transparent, and timely insurance recovery through expert representation and exceptional service.

VISION

To redefine the public adjusting experience by building a company where clients feel protected, adjusters are empowered, and trust is the foundation of every claim. We aim to become the most respected name in policyholder advocacy throughout the Southeast, known for doing things the right way—our way.

VISION

Client-First Advocacy: We work for the insured, not the insurance company. Every decision we make is rooted in what’s best for our clients.

Professionalism Over Aggression: We don’t fight for claims—we advocate with facts, ethics, and skill. Respectful communication and industry knowledge are our tools.

Integrity Always: We hold ourselves to the highest standards in how we represent clients, manage claims, and support each other.

Transparent Communication: From our internal systems to our client updates, clarity and accountability are core to how we operate.

Empowered Adjusters: We invest in our team’s growth with training, mentorship, and systems designed to support success—because confident adjusters deliver better outcomes.

Continuous Improvement: We are committed to learning, refining, and improving. Every claim, conversation, and challenge is an opportunity to grow stronger.

Brand Voice

1. Supportive & Reassuring

Your tone feels like a trusted guide — calm, capable, and steady in stressful times. You don’t talk at people, you talk with them.

“You don’t have to go through this alone — and you shouldn’t have to guess what’s fair.”

2. Expert but Not Intimidating

You’re highly knowledgeable, but never condescending. You explain things clearly, professionally, and without jargon. You make people feel empowered, not overwhelmed.

“We guide, educate, and advocate with purpose — restoring not just property, but peace of mind.”

3. Personal & Warm (Without Being Casual)

There’s a human behind the brand. It’s personal, but polished — warm, but not overly familiar. You make professionalism feel approachable.

“At TrueHaven, we don’t just handle claims. We walk with people through the chaos of loss and help them reclaim stability.”

4. Structured & Purpose-Driven

Everything you say feels intentional — grounded in values, clarity, and accountability. There’s no fluff — just thoughtful, well-placed words.

“This isn’t just a business. It’s a mission to do something meaningful, one claim at a time.”

5. Calm Strength

Even when clients are panicked or uncertain, your voice doesn’t over promise or dramatize — it offers steady confidence. You are the calm in their storm.

In a Sentence:

TrueHaven’s brand voice is steady, supportive, and smart — a calm, capable guide who leads with integrity, clarity, and care.

Tone & Voice Guide

We use this guide in all client-facing communication, marketing, and training materials.

Empathetic, knowledgeable, and professional

Speak with compassion and confidence. Clients are often stressed and overwhelmed—our job is to reassure them while staying grounded in facts.

Use collaborative, not combative language

We’re not here to fight carriers—we’re here to advocate, educate, and collaborate toward a fair outcome.

Instead of: “We battle the insurance company.” Use: “We guide you through the process and advocate for the best possible recovery.”

Speak to the insured as partners, not customers

Clients are active participants in their claims. Use inclusive language like “we’ll walk you through” or “together we’ll ensure”.

Avoid jargon, use plain language

Explain complex processes in a way any homeowner could understand. This builds trust and positions us as approachable experts.

Stay calm and constructive, even in conflict

If tensions rise (from carriers or clients), respond with clarity, empathy, and professionalism. Our tone reflects our credibility.

Reflect our brand personality

We are structured but human, professional but not cold, confident but never arrogant.

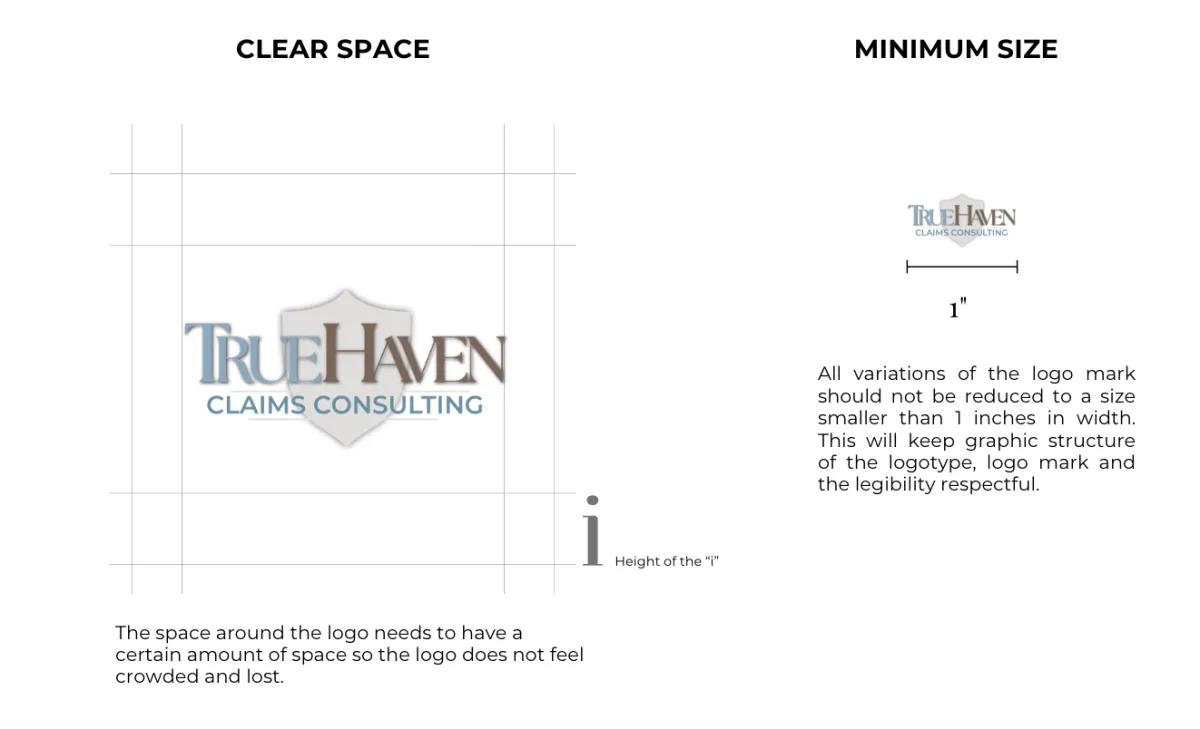

Logos

Brand Colors

Logo Usage

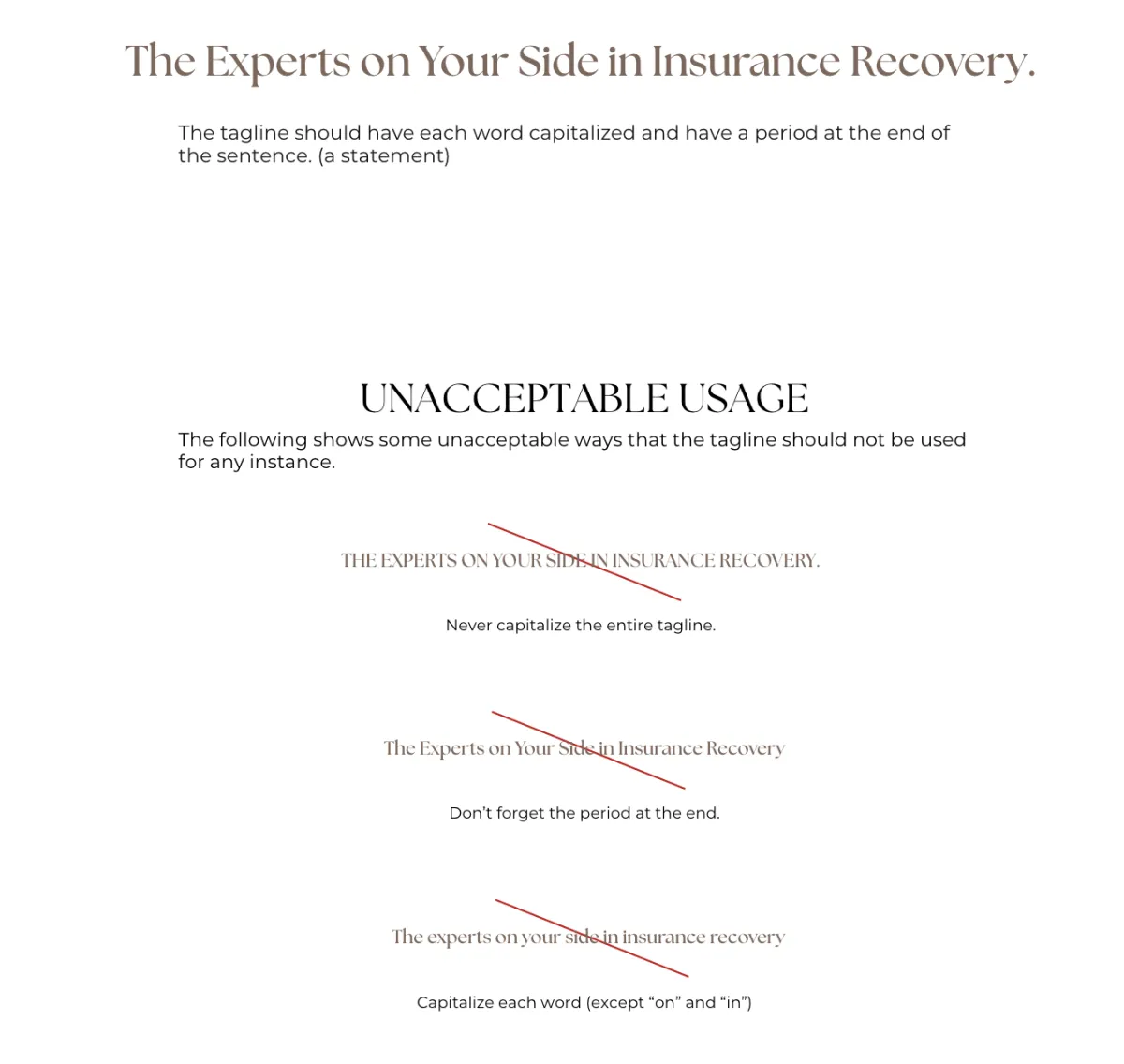

Unacceptable Usage

Tagline

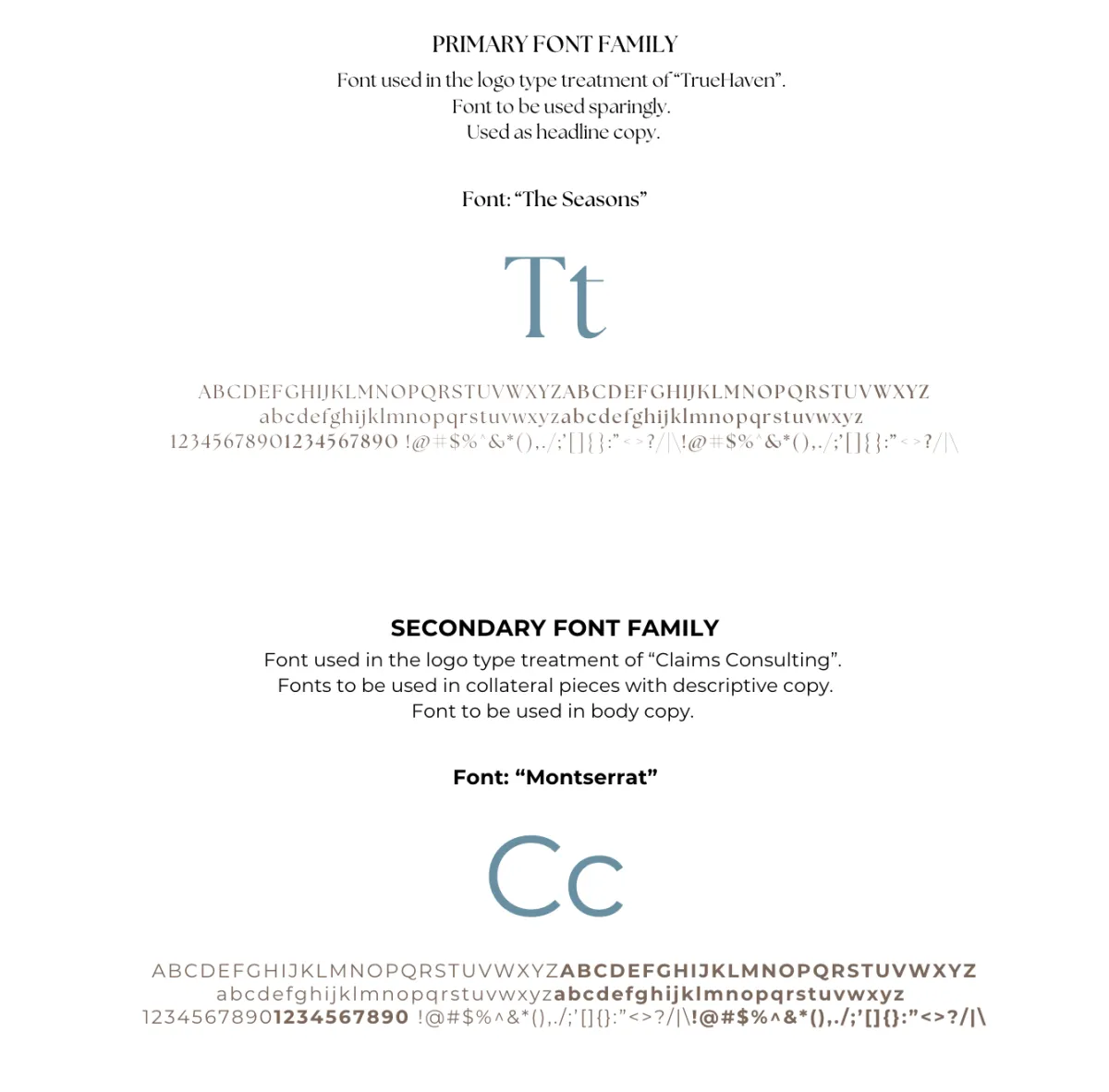

Typography

Media & Social

About TrueHaven Claims Consulting

TrueHaven Claims Consulting is a licensed public adjusting firm serving policyholders across the Southeast. We advocate for homeowners and business owners with professionalism, empathy, and clarity—ensuring fair and timely insurance recovery.

Built on a foundation of ethics and education, TrueHaven pairs licensed expertise with streamlined systems and hands-on support. We’re committed to doing things the right way—our way—and restoring peace of mind, one claim at a time.

BoilerPlate

TrueHaven Claims Consulting is a licensed Public Adjusting firm advocating for policyholders throughout the Southeast. With expert representation and compassionate service, we help clients navigate insurance claims with clarity, confidence, and integrity. Learn more at TrueHavenClaimsConsulting.com.

Hashtag

Florida Advertising Compliance Guide

1. Written or oral ads:

Cannot make the following statements or representations in any form:

A. Invite someone submit a claim when the policyholder does not have covered damage to insured property.

B. Invite someone to submit a claim by offering any monetary or other valuable inducement.

C. Say that there is “no risk” to the policyholder by submitting a claim.

D. Use a logo or shield, that implies or could mistakenly be construed to imply that the solicitation was issued or distributed by a governmental agency or is sanctioned or endorsed by a governmental agency.

Ads cannot be misleading, deceptive or untrue

2. Written ads:

A. Put the license number of the firm, and the designated primary adjuster (on the form filed with the state) on all written ads.

B. Required language in BOLD and ALL CAPS and in a font at least the same size as the rest of the text on all written ads, defined as “newspapers, magazines, flyers (including electronic ones), and bulk mailers”-does not include business cards that are standard size - “THIS IS A SOLICITATION FOR BUSINESS. IF YOU HAVE HAD A CLAIM FOR AN INSURED PROPERTY LOSS OR DAMAGE AND YOU ARE SATISFIED WITH THE PAYMENT BY YOUR INSURER, YOU MAY DISREGARD THIS ADVERTISEMENT.”

3. Oral ads:

Spokesperson ads: Make sure that the spokesperson says that they are not a public adjuster and they are simply endorsing the services of a public adjuster—as in your radio ads:…. “I am not a public adjuster but… “

4. Calls: involve solicitation rules that you need to consider

• You need a license to solicit a claim and solicitation is broadly defined as “initiating contact with any person, whether in person, by mail, by telephone, or otherwise, and thereby seeking, causing, urging, advising, or attempting to have any person enter into any agreement engaging the services of a public adjuster”.

• Your written ads will be ok as they are in the name of the public adjuster, but beware of call centers; you cannot initiate calls

Answering Telephone Calls. The answering of incoming telephone calls by unlicensed persons, “at the public adjuster’s place of business” (not defined) is not considered solicitation or unlicensed adjusting as long as the person answering the call engages in purely administrative matters and does not “interpret, analyze or explain insurance, an insurance contract, or a public adjuster contract, or cause, urge, advise or attempt to have someone enter into a contract for adjusting services.”

• What you can do is have the call center answer the call and then say that they will transfer the call to a public adjuster who can help them, or take a message with the caller’s contact info and give it to the public adjuster.

Georgia Advertising Compliance Guide

Every advertisement must display the adjuster’s name and license number.

Every advertisement soliciting or advertising business must be approved by the Commissioner (most public adjusters do not do this, but it is the law).

The following statements, made in any public adjuster’s advertisement or solicitation, are considered deceptive or misleading:

• A statement or representation that invites an insured to submit a claim when such insured does not have covered damage to such insured’s property;

• A statement or representation that invites an insured to submit a claim by offering monetary or other valuable inducement;

• A statement or representation that invites an insured to submit a claim by stating that there is “no risk” to the insured by submitting such claim; and

• A statement or representation, or use of a logo or shield, that implies or could mistakenly be construed to imply that the solicitation was issued or distributed by a governmental agency or is sanctioned or endorsed by a governmental agency.Written Advertisements: “Written advertisements ” includes only newspapers, magazines, flyers, and bulk mailers.

The following disclaimer, which is not required to be printed on standard size business cards, shall be added in BOLD PRINT AND CAPITAL LETTERS to all written advertisements in a font that is at least the same size as the rest of the ad: “THIS IS A SOLICITATION FOR BUSINESS. IF YOU HAVE HAD A CLAIM FOR AN INSURED PROPERTY LOSS OR DAMAGE AND YOU ARE SATISFIED WITH THE PAYMENT BY YOUR INSURER, YOU MAY DISREGARD THIS ADVERTISEMENT”.

*There have been questions as to whether a social media ad is an unprinted “flyer” and we are encouraged to err on the side of caution by including the disclaimer.

Innovation

Powered by tech.

Guided by people.

Focused on results.

Integrity

Clear communication.

Honest advocacy.

Always above board.

Excellence

High standards.

Professional support.

Every claim, every time.

Copyright 2025. TrueHaven Claims Consulting. All Rights Reserved.